Bill Frazer, a Certified Public Accountant and a superior (based on qualifications and knowledge) but unsuccessful recent candidate for City Controller, has weighed in against Proposition A, the “Pension Obligation Bonds” ballot initiative that is being touted by Mayor Sylvester Turner as well as some local establishment Republicans as critical to “solving” the Houston pension problem that some of us have been writing about for years.

Frazer recounts a host of problems with the reform itself, but most notably highlights that we’ve been promised POBs as part of Houston’s pension “solution” before:

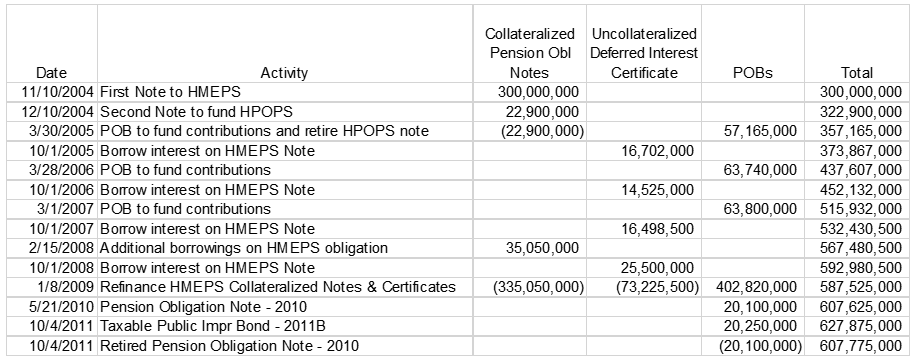

Houston has tried to “extend and pretend” with the use of pension debt before and the results have been terrible. Beginning in 2004, Houston issued $300 million in “pension obligation” debt. Mayor Bill White negotiated reforms to the 2001 benefit package, coupled with the agreement by the City to make extraordinary contributions to the pension funds. In a May 2011 op-ed[1], White cited an urban expert who called his reforms “a roadmap” for other cities. White noted that under his leadership, the City reached “agreements with the municipal and police pension boards, requiring longer service to earn benefits, beginning more affordable pension plans for new hires, increasing employee contributions” and ultimately cutting “the then-existing unfunded pension liabilities associated with the old plans by almost a billion dollars.”

In his op-ed, White wrote: “We planned to pay for a portion of the city’s obligation to pay down the pension liability with bond issues financed within the existing property tax rate, offset by limits on debt-financed capital improvements.”

Mayor White’s words from 2004 sound eerily similar to those used today by proponents of the POBs.

White went on to write that this debt was “phased out over six years,” implying that it was paid off. In reality, the debt was refinanced just four years later and principal reductions were extended through the year 2037. Instead of being “phased out”, the obligations were simply recast into longer-term bonds held by the public. The City did not actually make a payment that reduced the principal of this note until 2014 – almost 10 years after the original note was issued! (Bill Frazer, Core Municipal Report)

In Frazer’s highly informed view (he’s one of a handful of people in town I consider true experts on Houston public finance), the latest Turner gambit is just more of the extend-and-pretend, spend-then-borrow, can-kicking that’s been going on for years. Unlike some local establishment Republican voices (I love that “conservative” reference in the article), Frazer is not willing to get on board with the recent deal based solely on the optimism of those who negotiated the so-called “corridor” and promises of employee concessions that add up to different amounts, depending on where one looks and who is touting them.

Neither am I. The City of Houston, post-Harvey, can and must do better for current and future taxpayers. I encourage you strongly to consider voting NO on Proposition A, the Pension Obligation Bond question.

I don’t know. I am a City of Houston employee with 30 years of service and what I can ell you is that the main reason our pensions are underfunded is that for most of the 30 years I have been with them the city has failed to make its “STATUTORILY REQUIRED” contributions to the pension funds. That means the city has been breaking the law in order for politicians to deliver on unrealistic campaign promises (such as tax cuts) for decades. Once upon a time people who did such things went to prison. The city has repeatedly reneged on its promises to its workers, and is now trying to get out from under their responsibilities altogether. As my brother, a retired railroader, is fond of saying “if you take a man’s pension, you’ve stolen his life’s work. I understand nobody wants his taxes to go up to fund our pensions, but people like me have served the public for a lower than private sector wage for decades in order to earn that pension. Additionally, we have never had the option of failing to make our contributions. These were once 4% of salary, now they are 7% and will rise to 8% next year. Also we continue to get less and less for our money. Lastly, how would you respond if you worked for a company all your adult life and when retirement time came, you found the pension (that you sacfificed greater earnings for) would not be forthcoming?

You make good points. I think both municipal employees (I include HPD and HFD in this group) AND taxpayers should be up in arms over how their government has behaved.

The fact is, local government hasn’t made the statutorily required contributions because, as it turns out, the agreed amounts are unaffordable and unsustainable. Politicians like to dance around that truth because it’s EASY to make those promises and really hard to come to grips with the aftermath, but slick politicians can’t change facts on the ground.

We’ve had multiple instances of “kicking the can” (or “extend and pretend” as Frazer calls it). That basically just puts off the day of reckoning for the current group of politicians and transfers it to the next group of politicians. Meanwhile, the bills accumulate.

Some of us think it’s time to face the problem, once and for all, and stop the pretending. Not many people have argued that existing benefits should be cut, although the Turner Administration and the Republican Texas lege have effectively cut existing benefits for HFD in this deal. So, that precedent is set if this deal goes through.

The last check on this deal that taxpayers and muni employees have is this vote. I say we can do better, which is why I’m voting no.

I do think defined contribution plans moving forward are a must but I wouldn’t impose them on existing employees (although I might try to come up with a voluntary switchover plan).