THE FINANCIAL PERFORMANCE OF HARRIS COUNTY VS CITY OF HOUSTON

by Bill King

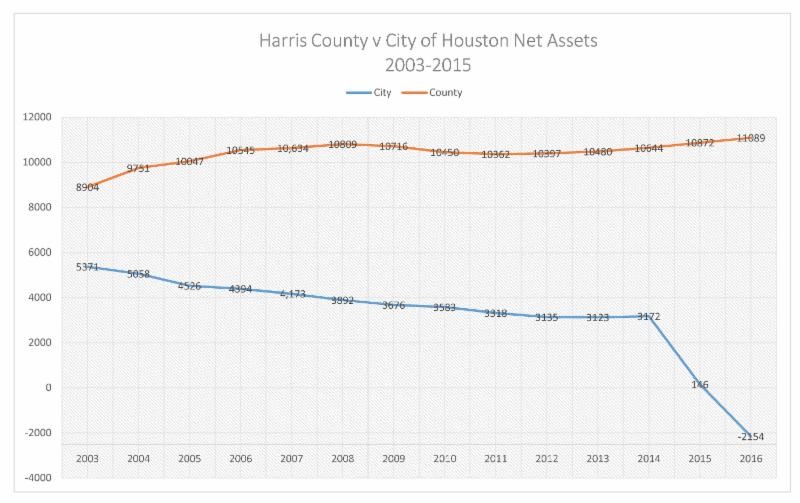

The divergence of the financial performance of the City of Houston and Harris County since 2003 is stark and telling. Since that time, the County has steadily and consistently increased its net assets while the City’s net assets have collapsed.

A governmental entity’s net assets are the amount by which its assets exceed its liabilities, what in the private sector we would call its net worth. The County has always maintained larger reserves relative to the City notwithstanding it has substantially less revenue. But the divergence between the two entities has become stunning now that the City has admitted the true dimensions of its pension debt.

(Note: The net assets reflected in this graph are the net assets reported in the Comprehensive Financial Reports issued by each entity except the net assets reflected for the City for 2016. The value reflected in this graph for the City for 2016 is its 2015 net assets minus the increased pension debt now admitted by the City. The actual net assets for the City as of 6/30/16 will be reported sometime between now and the end of the year and will likely be lower than value shown on this graph.)

2003 was the first year that the City’s financial reports began to reflect the disastrous effect of the dramatic increases to pension benefits granted during the third term of the Brown administration. Prior to those increases, the City’s pension plans were fully funded and the annual cost was under $100 million.

Since that time the City pension costs and debt have ballooned. Last year the pensions cost the City nearly $700 million and the City recently announced its pension debt is now over $8 billion.

In contrast, the County maintains a “cash balance” retirement plan for its employees. Cash balance plans are a hybrid approach combining some of the features of both defined benefit and defined contribution plans. These plans are not ideal, because they also can become underfunded like the traditional defined benefit plans that the City offers its employees.

But the County pension expense and debt are a fraction of the City’s. As of the County’s last audit, its pension debt was just over $700 million and it contributes about 14% of payroll to its plan compared to 32% for the City.

The difference in the County and City plans also dispels one of the great myths promoted by advocates of defined benefit pensions – namely, that you cannot recruit qualified employees without offering these crippling defined benefit plans. I have not heard anyone suggest that the County has had any difficulty recruiting employees. And by the way, every city in Texas, except the six largest cities, participates in a state-wide cash balance plan.

Personally, I am in favor of defined contribution plans exclusively for all governmental entities. But the contrast in how the County and the City have managed their respective retirement plans is dramatic. The difference in their respective pension debts (about $7 billion) accounts for almost all of the difference in their relative financial performance since 2003. The County plan is funded at 84% while the average of the City’s threes plans is now below 60% and the HMEPS plan is below 50%.

That difference is something that voters should keep in mind as they go the polls this November. With all of the attention that our whacky presidential election is getting, there has been little focus on the local races on the ballot. And the truth is that the results of local elections frequently have more impact on our daily life. So even if you are turned off and feel like sitting out the presidential race, be sure and go vote in our local election anyway. The stark difference in how the City and County have managed their finances in recent years shows why it is so important to vote in our local elections.

The article above is reprinted by permission of Bill King. Feel free to submit topical posts/essays for our consideration to [email protected]. As with our usual blog posts, the views expressed are those of the author.

It should be noted that Harris County does NOT contribute 14% to employee retirement programs, they match employee contributions as well as provide Social Security for a combined cost of closer to 23%. The suggestion that the county has no problem finding good employees is curious given all the related scandals they have had but by all means ask any deputy just how short of manpower they are, county residents told to demand more contract employees when faced with a lengthy wait, those who live in the unincorporated parts of the county getting to pay extra for deputies via their Homeowner Associations if they want to see a patrol car in their area.

** those who live in the unincorporated parts of the county getting to pay extra for deputies via their Homeowner Associations if they want to see a patrol car in their area. **

This issue is not unique to Harris County. Plenty of homeowner associations face the same issue within the City of Houston proper.