THE PENSION AMORTIZATION SCAM

by Bill King

Fair warning: This post is going to get way off in the weeds of the complex math that defined benefit pension plans entail. So if you are a mathphobe you may want to skip it. Unfortunately, because defined benefit pension plans are such complicated financial arrangements, there is no way to fully understand their impact without getting into the weeds, so here goes.

The amount an employer needs to set aside to fully fund a defined benefit pension each year consists of two parts. The first is the estimated cost of the benefits earned by employees that year. This is referred to as the “normal cost” or “service cost.”

Of course that estimate is an educated guess at best. It is fundamentally unknowable how much money needs to be set aside today for an indeterminate benefit to be paid 30 years from now. We know from experience, however, that employers almost always underestimate this cost, which results in the plans becoming underfunded over time. This is equivalent to the employer borrowing money from the pension plan. It is debt, plain and simple.

That brings us to the second part of what the employer should be contributing to its pension plan. In addition to the current cost, the employer should be contributing something toward paying off its debt to the plan. But how much should that be?

To be considered “actuarially sound” the employer should be contributing enough to pay off the unfunded liability in 30 years or less. Most people would assume that if an employer were going to pay off the debt in 30 years, the employer would run an amortization schedule to see how much it would need to contribute to the plan each year to pay off the debt, exactly the same way your bank calculates your mortgage payment.

But that is not how amortizations are done in the bizarre world of pension accounting. Rather, pension plans normally calculate the amortization schedule to pay off the debt using something called the “level percentage of payroll method.” It is a complete scam.

This amortization method estimates the total payroll for the employer over the next 30 years and calculates what percentage of that total payroll the employer will have to contribute to pay off the pension debt. When you work through the math, this amortization schedule results in a negative amortization for about the first ten years (i.e. the debt increases for the first ten years) because the payments are dramatically back-end loaded.

This is the method the City has used in the past to calculate its payments. To make worse, the City also “reset” the calculation every year resulting in the City being perpetually stuck in the first year of a negatively amortizing debt. I have learned that this is the amortization method the City intends to use in its new proposed pension plan, but, at least, has apparently agreed to drop the annual “reset.” So let’s see what that looks like.

For the purposes of this example, I am assuming that the concessions claimed by Turner have really been agreed to and really reduce the pension debt by $2.5 billion, neither of which has yet to be demonstrated. I am also ignoring the debt service on the $1.6 billion of pension bonds that taxpayers will be saddled with if this plan goes through.

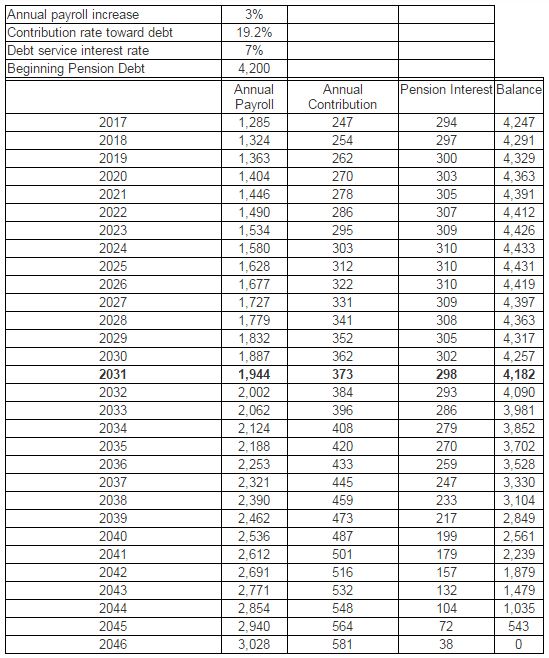

Making those assumptions, the City’s remaining pension debt would be $4.2 billion. Assuming the City’s payroll increases by 3% each year and assuming the pension plans earn 7% during the entire 30-year amortization period, the City will need to make an annual contribution of about 19% of payroll. This is what the amortization schedule would be.

As you can see, the overall pension debt remains above the 2017 level until 2031. More significantly, the payments begin low and then dramatically ramp up over the 30-year period, more than doubling. So if you are only going to be the mayor, say until 2020 or even 2024, you don’t have worry too much about how to pay off the pension debt.

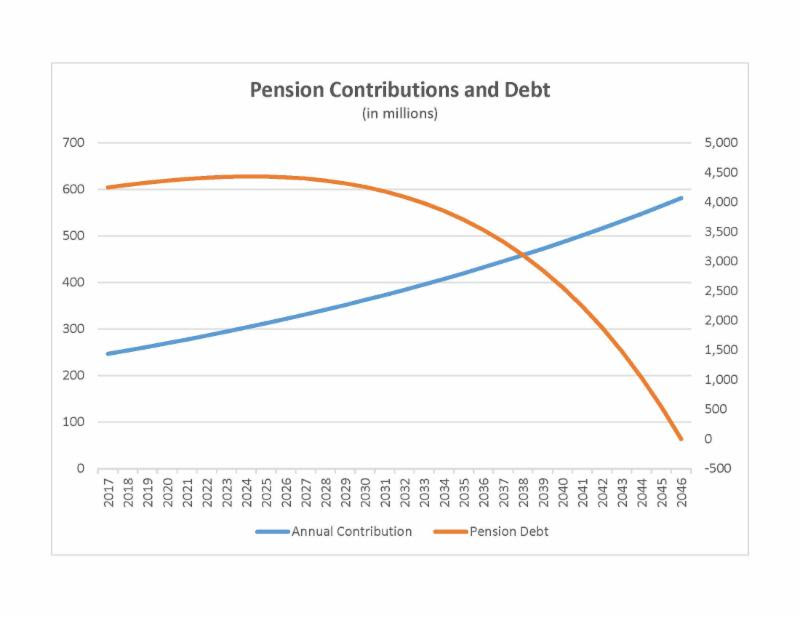

Here is what the numbers look like graphically:

Now let me add this caveat. This is a very simplified model of how this amortization method works. Very small changes in the assumptions make enormous differences in the outcome. For example, if the City’s payroll goes up by 5% annually, the payments are even more back-end loaded and the debt balloons to over $5 billion before it starts down, but it amortizes more quickly. Also, other factors, like the inflation rate, can dramatically affect the future contributions and scheduled pay-down of the pension debt.

Of course, even the presumption that we can project what the City’s payroll will be much less the inflation or interest rates over the next 30 years is absurd on its face in the first place. This is why the private sector has abandoned defined benefit plans for defined contribution plans.

But make no mistake. The only reason to use this squirrelly method to amortize the pension debt is to keep the payments low in the early years and kick this can down the road to the next City administration.

The article above is reprinted by permission of Bill King. Feel free to submit topical posts/essays for our consideration to [email protected]. As with our usual blog posts, the views expressed are those of the author.

The problem Mr. King runs into when “talking the numbers” again comes back to the fact that 1) he ignores major provisions of the proposed deal, 2) he makes wild assumptions not supported by any facts, and 3) since no specific deal currently exists, there is vast room for changes in the specific provisions to alter the outcome(s). Some of the basic provisions of the upcoming deal that have been disclosed include absolute caps should the three pension systems not perform as needed, a true 30 year cap instead of the existing revolving door he complains about, and a wealth of cuts to cost of living adjustments (COLAs), deferred compensation programs that were already cut out for new employees years ago (DROP), and include higher employee contributions.

Contrary to King’s narrative, there is no reason to believe employees are going to receive 3% increases in pay each year, many employees not receiving any contractual raises in years as their insurance costs increased sharply, retirees paying 300 to 400% more for medical coverage courtesy of Mayor Parker’s first year in office, and hiring remaining largely flat in public safety for ten years despite a growing population. He also forgets that by making such sweeping changes, he addresses the key component demanded by Wall Street which saves the city tens of millions of dollars in borrowing costs, this added to the millions more the TIRZ program is now paying to finance core city services than they were previously.

So what happens in those years when the pension funds make MORE than they are supposed to, the fact that Mr. King has ignored for years being that on average, the pensions make more than 8%, never mind the 7% rate the city is converting to? And what happens when salaries do NOT go up 3% annually as he suggests? For that matter, why does Mr. King feel the need to exaggerate the proposed amount of debt from the stated $1 billion to $1.6 billion when he was prepared to saddle the city with a great deal more than that to completely pay off pension debt and repair city streets? Given the municipal bond rates under 3% are a reality, various state legislators are even demanding/suggesting the city issue a great deal more such debt, Mr. King’s numbers for Houston’s investment grade muni’s very high indeed; his flip flop from advocating a tidal wave of such debt to his current belief that any such debt sounding like sour grapes over the choice of the electorate.

Make no mistake, there is some limited exposure to the city given the stated caps and potential for future employee cuts on top of these but the devil is in the details no matter what ever changing numbers naysayers like Mr. King use in their calculations. If this is his way of remaining in the spotlight past his 15 minutes, so be it, but let’s give Mayor Turner a chance to impress us all with the specific changes that are forthcoming, the man having already had more success in dealing with the issue in a few months than his predecessors had in 15 years.

** The problem Mr. King runs into when “talking the numbers” again comes back to the fact that 1) he ignores major provisions of the proposed deal, **

Not really. His various pieces have addressed the scant details that have been released to the public.

** 2) he makes wild assumptions not supported by any facts, **

The assumptions are not that wild. If Turner would release HIS model, then number crunchers wouldn’t have to make reasonable assumptions to have a discussion about whether the proposal makes sense. Turner is the one who held the press conference declaring the problem solved. Fine — it’s fair now to examine details, or if he won’t provide them, to make reasonable assumptions about them, and then run through the numbers.

** and 3) since no specific deal currently exists, there is vast room for changes in the specific provisions to alter the outcome(s). **

A point King makes. Nevertheless, it makes sense to establish a base case and start to examine the numbers. Where are your assumptions and your spreadsheet(s)?

** Some of the basic provisions of the upcoming deal that have been disclosed include absolute caps should the three pension systems not perform as needed, a true 30 year cap instead of the existing revolving door he complains about, and a wealth of cuts to cost of living adjustments (COLAs), deferred compensation programs that were already cut out for new employees years ago (DROP), and include higher employee contributions. **

The absolute caps are too high, and the real “pain” in Turner’s proposal comes when payments increase well after he’s left office. This is the same sort of can-kicking we have been before. Taxpayers have every right to examine this proposal and ask whether it makes sense to saddle future taxpayers with that significant a burden. I do not believe future Mayors/Councilmembers will be under any obligation to come up with the funds, and will seek to find ways to underfund once more, potentially making this a LESS secure arrangement for municipal employees. More kicking the can down the road. I’d be scared as hell of that if I were a municipal employee.

** So what happens in those years when the pension funds make MORE than they are supposed to, the fact that Mr. King has ignored for years being that on average, the pensions make more than 8% **

Nobody who is studying public pensions seriously thinks that AVERAGE 8% returns are realistic, and that creates a big problem for taxpayers, who are left on the hook for these unrealistic promises.

** his flip flop from advocating a tidal wave of such debt to his current belief that any such debt sounding like sour grapes over the choice of the electorate. **

No, that sounds like a narrative his opponents have crafted. King advocated taking on debt to handle current obligations, while shifting from defined benefit plans to eliminate future liabilities (which the Turner plan doesn’t do). That was a reasonable position, although I think taxpayers at least deserve someone to look at the unrealistic/unsustainable promises that Lee Brown saddled them with in the first place.

** Make no mistake, there is some limited exposure to the city **

There is tremendous exposure to taxpayers, who never get a seat at the negotiating table.

Turner has been careful not to release specifics (it’s a lot like Obamacare — it has to be passed to figure out what’s in it!), which is why some assumptions have to be made to run projections. The notion that the only voice we should be listening to is Mayor Turner’s is bizarre. Taxpayers have every right to have a closer look at the numbers.

I look forward to a lot more scrutiny of numbers/assumptions, and a lot less cheerleading, on this issue.